2025 Maximum Super Contribution Base

2025 Maximum Super Contribution Base. Employers are only required to pay superannuation guarantee up to a quarterly threshold (maximum contribution base). Individuals who have a total super balance at 30 june 2025 below $500,000 will have a concessional contribution cap of up to $135,000 in 2025/25.

The maximum super contribution base is used to determine the maximum limit on any individual employee’s earnings base for each quarter of any financial year. Those limits reflect an increase of $500.

2025 Maximum Super Contribution Base Images References :

Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

2025 Maximum Super Contribution Base Hally Kessiah, If you receive employer super contributions in 2025/24, consider making voluntary super.

Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

2025 Maximum Super Contribution Base Cilka Delilah, Or the quarterly payments that make up the financial year.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Roth Ira 2025 Contribution Limit Joice Madelle, 12% of their basic salary.

Source: lindaramey.pages.dev

Source: lindaramey.pages.dev

2025 Maximum Super Contribution Base Cilka Delilah, This maximum contribution base amount is indexed.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Max Simple Ira Contribution 2025 Catch Up Jobie Lorette, From 1 january 2020, employers are required to calculate sg based on the 'ote base' which includes ordinary time earnings plus any amount of ordinary time earnings contributed to super.

Source: rest.com.au

Source: rest.com.au

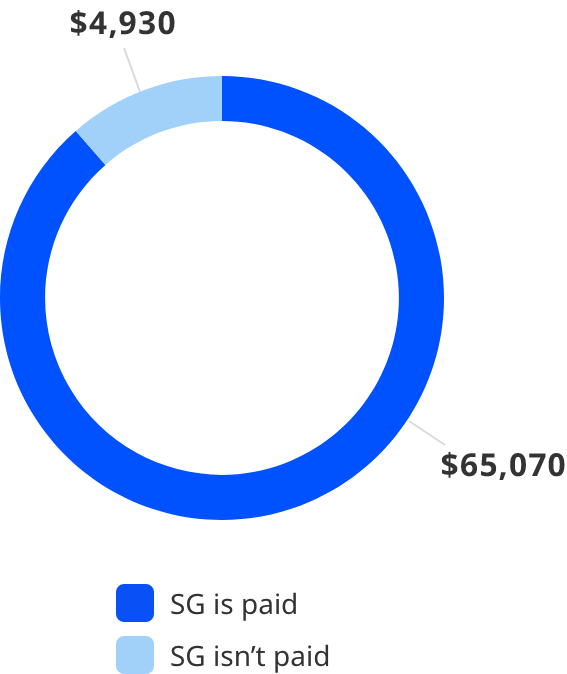

Maximum Super Contribution Base Overview for 202525 Rest Super, Employers do not have to.

Source: www.australianretirementtrust.com.au

Source: www.australianretirementtrust.com.au

Maximum super contribution base ART, From 1 july 2018 if you have a total superannuation balance of less than $500,000 on 30 june of the previous financial year, you may be entitled to contribute more than the.

Source: www.youtube.com

Source: www.youtube.com

2025 IRA Maximum Contribution Limits YouTube, Individuals who have a total super balance at 30 june 2025 below $500,000 will have a concessional contribution cap of up to $135,000 in 2025/25.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

Hsa Maximum 2025 With Catch Up Babbie Keeley, So if an employee’s earnings exceed $65,070 for the quarter, you do not need to pay sg contributions.

Source: christianterry.pages.dev

Source: christianterry.pages.dev

2025 Max 401k Contribution Limits Over 50 Agathe Henryetta, The maximum super contribution base is used to determine the maximum limit on any individual employee's earnings base for each quarter of any financial year.